Despite their many differences, most companies that achieve sustainable growth share a common set of motivating attitudes and behaviors that can usually be traced back to a bold, ambitious founder who got it right the first time around. The companies that have grown profitably to scale, while maintaining the internal traits that got them there in the first place, often consider themselves insurgents, waging war on their industry and its standards on behalf of an underserved customer, or creating an entirely new industry altogether. Such companies possess a clear sense of mission and focus that everyone in the company can understand and relate to (in contrast with the average company, where only two employees in five say they have any idea what the company stands for). Companies run in this way have the special ability to foster employees’ deep feelings of personal responsibility (in contrast with the average company, where a recent Gallup survey shows that only 13 percent of employees say they are emotionally engaged with their company).

They abhor complexity, bureaucracy, and anything that gets in the way of the clean execution of strategy. They are obsessed with the details of the business and celebrate the employees at the front line, who deal directly with customers. Together, these attitudes and behaviors constitute a frame of mind that is one of the great and most undervalued secrets of business success.

We call it the founder’s mentality.

The founder’s mentality constitutes a key source of competitive advantage for younger companies going up against larger, better-endowed incumbents, and it consists of three main traits: an insurgent’s mission, an owner’s mindset, and obsession with the front line. In their purest expression, these traits can be found in companies that are founder-led, or where the clear influence of the founder still remains in the principles, norms, and values that guide employees’ day-to-day decisions and behaviors.

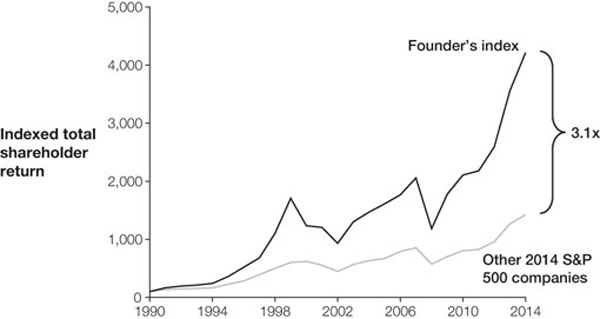

In our analyses, surveys, and interviews, we’ve found a consistently strong relationship between the traits of the founder’s mentality in companies of all kinds—not just start-ups—and their ability to sustain performance in the marketplace, in the stock market, and against their peers. Since 1990, we’ve found that the returns to shareholders in public companies where the founder is still involved are three times higher than in other companies.

Founder-led companies outperform the rest:

The most consistent high performers exhibit the attributes of the founder’s mentality four to five times more than the worst performers. Furthermore, we’ve determined that of the roughly one in ten companies that achieve a decade of sustained and profitable growth, nearly two in three are governed by the founder’s mentality. These are all remarkable numbers.

All too often, however, companies lose the founder’s mentality as they become larger. The pursuit of growth and scale adds organizational complexity, piles on processes and systems, dilutes the sense of insurgency, and creates challenges in maintaining the original level of talent. These sorts of deep, subtle internal problems, in turn, lead to deterioration on the outside.

How else to explain the disappointments of companies that once dominated their business and seemed to have everything—growing markets, massive investable funds, proprietary technologies, best-known brands, leadership in their channels? In the 1990s, for example, Nokia rocketed to the top of the handset market.

During that decade, we estimate, the company captured more than 90 percent of the market’s global profits and seemed poised to maintain its leadership for years to come. It even was putting in place many of the elements for next-generation smartphones: it had developed some of the earliest small-touchscreen technology, was the global leader in selling tiny cameras, had learned how to distribute music, and was one of the first companies to offer free e-mail on its phones. Yet somehow, overloaded by its own growth and blinded by its burgeoning organizational complexity, the company failed to capitalize on its advantages and take the lead in developing next-generation phones, despite calls from some of its own engineers to do just that.

None of this stemmed from a lack of resources or opportunity. Nokia sat on top of one of the biggest growth markets the world had ever seen, and on top of one of the biggest piles of cash in history. But instead of thinking like an insurgent and investing in the future, it gave out 40 percent dividends and used its cash to buy back large quantities of its own stock. Within just a few years, Apple, Samsung, and soon Google had seized the smartphone market, and Nokia, once a model of innovation and insurgent-style thinking, was in steep decline. A board member, when interviewed about what happened, pointed to internal factors, not competitive moves, and concluded simply, “We were too slow to act.” In our studies of growth crises, we’ve come across a plethora of companies like Nokia—companies that seemed on the outside to have everything (market position, brand, technology, customer base, enormous financial resources) but ultimately lost it all in shocking fashion, because of how they failed to play the internal game. But we’ve also encountered many remarkable and inspiring stories of the opposite nature —companies that seemed on the outside to have no hope but that were revived by leaders who virtually refounded the company from the inside.

Does Your Organization Have a Founder’s Mentality?

A company has the founder’s mentality when its employees live and breathe the principles and entrepreneurial approach characteristic of great founders. The Founder’s Mentality® diagnostic survey is the first step in the process of understanding whether your company is really retaining the founder’s mentality as it grows, and the biggest internal barriers that are eroding it. To get started, consider each of the following statements and rate yourself or your organization using a numerical scale where 1 = “Strongly Disagree” and 5 = “Strongly Agree.”

Insurgency

Bold mission

- We are clear about the “big why”—the unique purpose for why we are in business.

- I find our mission to be personally energizing and inspiring to those around me.

“Spikiness”

- Our organization is clear on the one or two capabilities that drive our differentiation with customers.

- We have a repeatable model for growth that will allow us to capture or extend leadership in our markets.

Limitless horizons

- We are focused on the long term in our investments and our budgetary decisions; managing quarterly earnings is truly secondary.

- We embrace turbulence and are experimenting and building new business models ahead of the competition.

Front-line Obsession

Relentless experimentation

- We innovate and experiment a lot in the field; this drives our learning and is a competitive advantage.

- We have an efficient feedback process in place to help us understand what is working and take corrective action quickly.

Front-line empowerment

- We are the most sought-after employer by top talent in our industry.

- We treat our front-line people as the heroes of our business and do whatever is needed to support them.

Customer advocacy

- We are clear about who our core customers are; their loyalty is a competitive advantage.

- The voice of the customer is fully represented in all important meetings.

Owner’s Mindset

Strong cash focus

- We have a sharp focus on cash and costs; we treat each dollar as if it is our own.

- We rapidly redeploy people and capital wherever they are most critical to the business.

Bias for action

- Our organization makes and acts upon key decisions faster than our competitors; speed is an advantage for us.

- People in the organization are quick to take on personal responsibility and risk to do the right thing.

Aversion to bureaucracy

- We have simplified our initiatives to focus on the biggest priorities that deliver value.

- Our planning and review processes are the best in our industry, efficiently reallocating resources to make our front line more competitive.

Overall Statements

- Our biggest barriers to growth and future success are much more internal than external; our fate is in our hands.

- Our main competitors five years from now will be different companies than those in the past five years.

Scoring

At the highest level is your cumulative score. The data we’ve seen typically groups companies in four ranges, from a strong founder’s mentality (total score across all statements is greater than 75), to waning (total score of 60–75), to low (total score of 45–60), to founder’s mentality lost (total score is less than 45).

While the overall score is a strong indicator of a company’s health on the inside and its ability to sustain profitable growth on the outside, the pattern is even more important for identifying the highest level of issues. This is because companies don’t lose the founder’s mentality uniformly, but see big drops in one or another dimension. Taking this further and ultimately drilling down to the root cause of any decline is critical (that is, understanding the unresolved issues that the front line is grappling with, getting real feedback from customers, and so on)

Contributed to Branding Strategy Insider by: Chris Zook with the permission of Harvard Business Review Press. Excerpted and adapted from The Founder’s Mentality: How to Overcome the Predictable Crises of Growth. Copyright 2017 Bain & Company, Inc. All rights reserved.

The Blake Project Can Help: Please email us for more about our purpose, mission, vision and values workshops.

Branding Strategy Insider is a service of The Blake Project: A strategic brand consultancy specializing in Brand Research, Brand Strategy, Brand Licensing and Brand Education